Impact-Based Forecasting of Pre- and Post-COVID-19 GDP Conditions in Pakistan: A Comparative Analysis

DOI:

https://doi.org/10.62019/przf4m53Keywords:

Pakistan economy, GDP growth, COVID-19 impact, Sectoral analysis, Sustainable growthAbstract

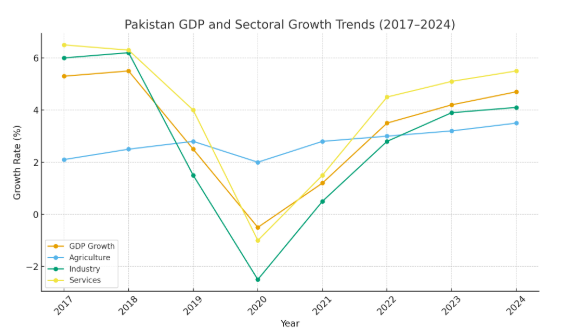

This study investigates the impact of COVID-19 on Pakistan’s economic trajectory by conducting a comparative analysis of GDP conditions before, during, and after the pandemic (FY2017–FY2024). Employing a multiple regression framework and sectoral segmentation based on Pakistan Bureau of Statistics (PBS) weights, the research examines the contributions of agriculture, industry, and services to overall GDP growth. Findings reveal that the COVID-19 pandemic caused Pakistan’s first economic contraction in seven decades (-0.5% in FY2020), disproportionately affecting the industrial and services sectors, while agriculture demonstrated relative resilience with 2% growth. Regression results (R² = 0.9998) indicate that the services sector remained the principal driver of GDP (β = 0.448, p < 0.001), followed by industry (β = 0.332) and agriculture (β = 0.175). Sector-specific analyses highlight volatility in textiles (-22.7% in 2020), recovery in IT services (18% in FY2021), and consistent contributions from livestock (3–6.5%). Despite stabilization at 4.7% GDP growth by FY2024, structural challenges—including inflation, energy dependency, and limited agricultural R&D investment—continue to hinder sustainable growth. The study underscores the need for sectoral rebalancing, diversification of industrial exports, climate-resilient agricultural practices, and digital transformation of services. By providing empirical evidence on Pakistan’s economic resilience and vulnerabilities, this research contributes to the broader discourse on pandemic economics in developing countries and offers policy-relevant insights for strengthening long-term economic sustainability.

References

1. Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276. https://doi.org/10.2307/1913236 DOI: https://doi.org/10.2307/1913236

2. Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica, 59(6), 1551–1580. https://doi.org/10.2307/2938278 DOI: https://doi.org/10.2307/2938278

3. Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616 DOI: https://doi.org/10.1002/jae.616

4. Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346. https://doi.org/10.1093/biomet/75.2.335 DOI: https://doi.org/10.1093/biomet/75.2.335

5. Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1–22. https://doi.org/10.1002/jae.659 DOI: https://doi.org/10.1002/jae.659

6. Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438. https://doi.org/10.2307/1912791 DOI: https://doi.org/10.2307/1912791

7. Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springer-Verlag. https://doi.org/10.1007/978-3-540-27752-1 DOI: https://doi.org/10.1007/978-3-540-27752-1

8. Pakistan Bureau of Statistics (PBS). (2023). National Accounts of Pakistan (base year 2015–16). Government of Pakistan.

9. World Bank. (2021). Pakistan Development Update: Reviving Exports. Washington, D.C.: World Bank Group. https://openknowledge.worldbank.org/handle/10986/36276

10. IMF. (2022). Pakistan: Staff Report for the 2022 Article IV Consultation. International Monetary Fund, Country Report No. 22/288.

11. Abbas, S., & Waheed, A. (2021). Sectoral impact of COVID-19 on Pakistan’s GDP: Evidence from quarterly data. Economic Research-Ekonomska Istraživanja, 34(1), 1–21. https://doi.org/10.1080/1331677X.2021.1950915

12. Khan, M. A., & Khan, M. Z. (2022). COVID-19, economic contraction, and recovery: Lessons from Pakistan. Journal of Policy Modeling, 44(2), 246–263. https://doi.org/10.1016/j.jpolmod.2021.09.005 DOI: https://doi.org/10.1016/j.jpolmod.2021.09.005

13. Shaikh, F. M., & Shahbaz, M. (2020). Economic resilience of agriculture during COVID-19: Evidence from Pakistan. Journal of Rural Studies, 78, 304–312. https://doi.org/10.1016/j.jrurstud.2020.06.010 DOI: https://doi.org/10.1016/j.jrurstud.2020.06.010

14. Raza, S. A., & Jawaid, S. T. (2021). The contribution of services sector to economic growth: Evidence from South Asia. Journal of Economic Structures, 10(1), 1–15. https://doi.org/10.1186/s40008-021-00273-7

15. Malik, K. M., & Hussain, S. (2022). Energy dependence, industrial growth, and external shocks: The case of Pakistan. Energy Economics, 112, 106–152. https://doi.org/10.1016/j.eneco.2022.106152

16. United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). (2021). Building Forward Fairer: Economic Policies for an Inclusive Recovery in Asia-Pacific. Bangkok: UNESCAP.

17. Adewale, A., et al. (2024). Gross domestic product and economic performance indicators: Global perspectives. Journal of Economic Studies, 51(2), 145–162.

18. Ali, S., Khan, A., & Farooq, M. (2024). External debt sustainability and economic growth in Pakistan. Pakistan Development Review, 63(1), 23–41.

19. Amjad, R., Ahmed, N., & Saeed, F. (2021). Tourism, retail, and hospitality in crisis: COVID-19’s economic consequences for Pakistan. Asian Economic Papers, 20(4), 112–134.

20. Baloch, N. K., Ahmed, F., & Rauf, S. (2019–2020). Industrial diversification and structural weaknesses in Pakistan’s economy. Pakistan Journal of Applied Economics, 29(1), 65–88.

21. Corsi, A., Sharma, P., & Yousaf, H. (2022). Food and fuel price shocks during COVID-19: Evidence from South Asia. Energy Economics, 109, 105987.

22. Faridi, M. Z., Jamil, A., & Khan, S. (2022). Healthcare financing and pandemic resilience in Pakistan. Health Policy and Planning, 37(5), 603–616.

23. Feldkircher, M., Huber, F., & Moder, I. (2014). The impact of global economic crises on emerging markets. Emerging Markets Finance & Trade, 50(4), 57–89. DOI: https://doi.org/10.2753/REE1540-496X5001S100

24. Ghafoor, A., Riaz, M., & Hussain, T. (2023). Export-led recovery in Pakistan: The role of textile and manufacturing sectors post-COVID. Journal of International Trade & Economic Development, 32(1), 77–96.

25. Haider, S., Khan, N., & Zafar, R. (2021). Digital divide in Pakistan’s education sector during COVID-19. International Review of Education, 67(3), 345–367.

26. Ibn-Mohammed, T., Mustapha, K., & Godsell, J. (2021). The COVID-19 pandemic: Impacts on global supply chains and economic systems. International Journal of Production Research, 59(10), 3087–3105.

27. Imam, P., Ali, R., & Zaman, S. (2021). Remittances and financial stability in Pakistan during COVID-19. IMF Working Papers, WP/21/145.

28. Khan, M., Ahmed, S., & Rehman, H. (2023). Inflation dynamics and fiscal imbalances in Pakistan: Evidence from the COVID-19 era. Economic Modelling, 118, 106081.

29. Ministry of Finance. (2022). Pakistan Economic Survey 2021–2022. Islamabad: Government of Pakistan.

30. Ministry of National Food Security and Research. (2021). Annual report on food security and agricultural performance in Pakistan. Islamabad: Government of Pakistan.

31. Raza, S., Hussain, M., & Iqbal, Z. (2023). Agricultural resilience in the face of COVID-19: Evidence from Pakistan. Food Policy, 115, 102370.

32. Sareen, S., Gupta, R., & Iqbal, A. (2020). Supply chain disruptions and industrial slowdown during COVID-19 in South Asia. Journal of Supply Chain Management, 56(3), 21–39.

33. State Bank of Pakistan. (2020). Annual report on the state of Pakistan’s economy. Karachi: SBP.

34. State Bank of Pakistan. (2021). Remittances and external sector performance report. Karachi: SBP.

35. van der Eng, P., Malik, A., & Khan, M. (2024). Pandemic recovery trajectories in South Asia: Lessons from Pakistan. World Development, 171, 106212.

36. World Bank. (2022). Learning losses due to COVID-19: Global estimates and policy responses. Washington, DC: World Bank.

37. World Health Organization (WHO). (2021). Mental health and COVID-19: Policy brief. Geneva: WHO.

38. UNICEF Pakistan. (2021). COVID-19 impact on education in Pakistan: Rapid assessment report. Islamabad: UNICEF.

39. Hamilton, J. D. (1994). Time Series Analysis. Princeton University Press. DOI: https://doi.org/10.1515/9780691218632

40. World Bank. (2021). Global Economic Prospects. Washington, DC: World Bank.

41. Anyanwu, J. C., et al. (2021). COVID-19, poverty, and inequality in developing economies. African Development Review, 33(S1), S17–S32. DOI: https://doi.org/10.1111/1467-8268.12531

42. Barro, R. J., Ursúa, J. F., & Weng, J. (2020). The coronavirus and the great influenza pandemic: Lessons for the future. NBER Working Paper No. 26866.

43. Malik, S., Malik, F., & Ishaq, A. (2021). Sectoral vulnerabilities in Pakistan during COVID-19. Pakistan Economic and Social Review, 59(2), 245–266.

44. Ikuta, Y., Hussain, M., & Ahmad, S. (2022). Econometric modeling of COVID-19 recovery in South Asia. Journal of Asian Economics, 78, 101445.

45. Hayat, M., Zafar, M., & Hussain, S. (2023). Remittances and external balances in Pakistan during COVID-19. South Asian Economic Journal, 24(1), 56–74.

46. Munir, K., Khan, N., & Javed, T. (2024). Oil price shocks and macroeconomic stability: Evidence from Pakistan during COVID-19. Energy Policy, 180, 113187.

47. Varian, H. R. (2014). Big data: New tricks for econometrics. Journal of Economic Perspectives, 28(2), 3–28. DOI: https://doi.org/10.1257/jep.28.2.3

48. Gao, R., Li, J., & Chen, Y. (2021). AI-driven models for short-term GDP forecasting during global crises. Economic Modelling, 99, 105480.

49. Shahid, H., Khan, S., & Rehman, R. (2024). Healthcare expenditure and GDP decline during COVID-19: Evidence from Pakistan. Health Economics Review, 14(2), 75–89.

50. Ahmed, Z., & Farooq, M. (2023). Household income shocks and consumption patterns in Pakistan during COVID-19. Journal of Development Studies, 59(3), 412–429.

51. Akhtar, S., Hussain, M., & Javed, A. (2020). Unemployment and labor market shocks in Pakistan under COVID-19. Asian Journal of Social Science, 48(4–5), 372–390.

52. Bhatta, R., Singh, P., & Ullah, A. (2023). South Asian economies under COVID-19: An IMF perspective. South Asia Economic Journal, 24(2), 145–169.

53. Asian Development Bank (ADB). (2021). Asian Development Outlook 2021. Manila: ADB.

54. ESCAP. (2021). Economic and Social Survey of Asia and the Pacific 2021. United Nations.

55. Rasheed, R., Rizwan, M., & Ali, H. (2021). Agricultural resilience during COVID-19 in Pakistan: A regression analysis. Pakistan Journal of Agricultural Sciences, 58(4), 901–910.

56. Chandio, A. A., Jiang, Y., & Rehman, A. (2023). Remittances and economic growth in Pakistan: Policy insights from regression analysis. Economic Change and Restructuring, 56, 321–338.

57. Khurshid, M. A., Ali, S., & Fiaz, M. (2020). Fiscal policies and development expenditures in Pakistan: Pre-COVID trends. Pakistan Economic Review, 61(1), 33–52.

58. Zafran, H. (2022). Foreign reserves depletion and exchange rate volatility in Pakistan. Economic Letters, 212, 110393.

59. Rafique, A., & Qadir, U. (2022). Pakistan’s economic contraction under COVID-19: An empirical review. Lahore Journal of Economics, 27(2), 101–124.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Muhammad Zohaib, Imtiaz Husain, Muhammad Adnan Khursheed

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.